Abstract:

Housing is a need, a measure of wealth, a means of income, a modicum of privacy and provider of security, to any individual, across the economic spectrum. Closer home India has the world’s largest youth population comprising millennials and Gen Z. This discussion is therefore meaningful to ensure India addresses the needs of its largest

potential buying class – the millennials and Gen Z.

As the earlier generations of Baby Boomers and Generation X age further, the emerging cohort in the property buying markets the world over, are the millennials and maybe in a smaller measure the Gen Z. This generation is plagued by its own problems when it comes to affordability and ability to purchase property. Notwithstanding this, they also exhibit distinct characteristics in home purchase process, right from the search to selection to the actual occupation of new homes. This blogpost enables the reader to understand the home buying priorities of millennials and the home consumption attributes of the generation coming next after the millennials, Generation Z.

I once overheard someone say and mentally sighed.

“I want to own a house badly, but would need to wait and don’t know how long!” I could easily guess to which generation the person who said it, belonged,

She was a Millennial.

Elsewhere I overheard….,

“Can life be only about owning houses? How about other things and places other than on Earth?”

I turned back and looked, not to find an iconoclast of sorts, or a monk, but an earnest youngster, a 22-something!

He was a Gen Z.

Real estate economists maintain that the demand for housing is the function of two key factors

1. The desire and willingness to purchase a house

2. The ability to purchase

Both the factors are necessary to enable home purchase. If either one, or both are not fulfilled home buying will fail to materialize. Let us see how this plays out with the millennials (born between 1980-1996) and Gen Z generations born between 1996- 2015, (Pew Research).

1. The desire and willingness to purchase:

As per a Forbes article (2019), the typical millennial in the USA, has been more often than not doing one of these things i) living in the parental home or ii) renting a home. Which makes home buying and changing a rather slow process. However, their desire to buy a home is more marked, and stronger compared to the earlier generations. The reason for a slow entry into home ownership lies elsewhere.

The Gen Z has been showing a greater preference in buying their own house. They prefer space over amenities. They prefer affordable housing, and are likely to make decisions in favor of affordability.

2. The ability to purchase:

This is determined by an individual’s ability to take a long- term home loan. The underlying factors for this to happen lies in a person’s ability to get reasonable and steady employment.

The reason for the millennials’ slow entry into home ownership has been due to protracted stagnant wages, uncertainty in jobs, higher cost of living, education loans and rising house prices. Especially so, in the western world. Asian countries seem to be different.

In case of Gen Z, those who have entered the job market when they were 16 yrs of age, doing various jobs have more than one income source. Despite having saved less than 5 years before buying a home, they approach and avail of the fixer upper loan option to buy property while simultaneously carrying student loan debts. Being entrepreneurial in nature they are likely to make the money to service debt, more quickly.

Having said this, the rest of the article presents in detail how this plays out when it comes to the two younger generations namely the millennials and the Gen Z.

a) Millennials

By the year 2025, the largest workforce in the world is going to be the millennials at approximately 75 percent of the total employees, and 64 per cent of the full-time workers globally (Deloitte, 2014).

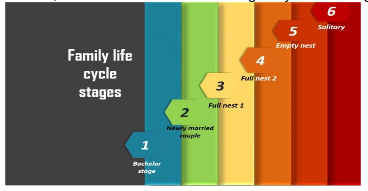

Millennials compared to the early two generations (Baby Boomers and Gen X) have not been copious asset owners as of now. Unlike the millennials, wealth acquisition for the previous two generations has been pretty much a done deal. The Baby Boomers and Gen X as soon as they turned adults, secured jobs and a steady income, had bought homes! Having begun very early, over their lifetimes they went through 4-5 property buying cycles. These acquisitions are typically in the nature of ‘shared accommodation, start up home, a move up home, a second home, down sized homes’, that correspond to the expanded or contracted life cycle of a family (ibid Wells and Gruber, 1966). With mortgage becoming the mainstay of house purchase, changing house was an easy matter too. Upgrades required rejigging the mortgage and top ups for home improvements. As a result, homes were more often changed by the earlier generations.

Fig. 1 Stages in the Family Life Cycle

(Image source: Walia and Chetty, 2020)

While the mortgage story was becoming more favourable for home buyers, perhaps way too favourable, the economic crash of 2008 happened in the USA. Consequently, jobs were lost, as mortgage companies and the entire banking system collapsed in a dominoes effect, the globe. The job losses meant distress for the millennial home owners who had bought homes and suddenly a sizeable chunk found it difficult to keep the roof over their heads. The point of origin lay in the defaults in repayment instalments on house mortgages!

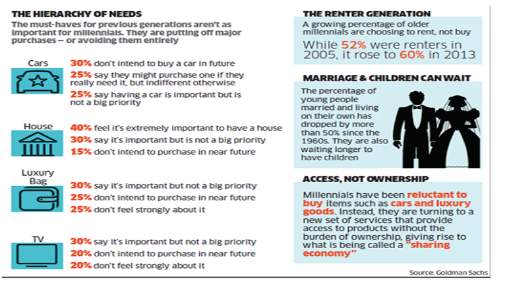

As the situation has been until 2020, especially from the western world, more millennials tend to either live with their parents or then are content to continue in rental accommodations, as compared to the earlier generations. Baby Boomers/Gen X when in the age group of 25-40 yrs would more likely have owned a property as compared to the millennials. Student debt in the USA reached about $1.6 trillion, by March 2020. Education loan repayments loom large over their heads not helping much the cause of home ownership. Millennials came into the economic mainstream, somewhere around the year 2000, and most have found it difficult to earn adequately and acquire property due to the series of economic shocks that have hit the world ever since. This major reason and a few others have been brought out by Shah in the book Millennials Poised to Lead. They also face employment problems with wages and raises not seeing much improvements. The problem has been so acute in the USA in the period that home ownership has decreased by 2.6%. There was a commensurate rise in spending on rental leases of 3.2%.

With the marriage age being higher in the USA at around 27.8 years for women and 29.8 yrs for men. The average age of a first -time mother is around 26 yrs+ for college educated and women living in urban areas (NCHS, 2016). Household formation among millennials is far slower as compared to the Baby Boomers/Gen X, as more millennials are either not married or partnered. In 2018, less than 60 percent of people in the US, in the age group of 25-34 years lived with either a spouse or partner as compared to 80 percent in 1967 (US Census Bureau, 2018). Refer Fig. 2, a study by Goldman Sachs as early as 2013 on millennials’ priorities and preferences.

Fig. 2 Millennial Priorities and Preferences

Which Millennials are buying and what is their preference?

The millennials who are in the home buying market are those who’ve been able to hold down a steady job, having a steady income, despite difficult market conditions and lay -offs, at least in the USA and Europe. U.S. Census Bureau Housing Vacancies and Homeownership report revealed that the homeownership rate for 25 to 34-year-olds has increased slightly from 36.5% in Q4-2018 to 37.6% in Q4-2019. The cohort being well educated, their incomes are higher than those of young adult households in the last 50 years. The median income of educated millennials buying houses is $69,000. When they firm up their decision to buy, they avoid start-up homes in favour of larger or more upscale properties, where they tend to buy in the suburbs instead of the more costly urban areas. Perhaps this could be because of the long wait they’ve had to own their own home.

Millennials are tech-savvy which means they insist that agents and brokers provide features like live streaming and videos to enable them to arrive at their buying decision. The National Association of Realtors reports in Homebuyer & Seller Generational Trends in 2019, that 81% of older millennials found their house using a mobile app. Like their overall preference for online, even homes are preferred to be bought through the use of online interventions. According to a Real Estate in a Digital Age Report, 99% of millennials start their home search online and 58% tended to buy their current home on a mobile device. To cater to this, agents and brokers prepare digital platforms for home buyers to ease the search for property. Even housing finance agencies have gone digital and introducing digital mortgage platforms easing the application for loans and managing them online. A special mention here of a feature less emphasised in earlier generations, but central to millennials

is the demand for larger yards to house their pets and for the organic gardens.

Having said that when it comes to home amenities the drivers of housing demand apart from sustainable neighbourhoods are the availability of smart homes equipped with the latest tech. wireless connection of gadgets and appliances, security systems with specialised closets for routers, hubs, and back- up power supply. Included are redundancies of empty conduits to provide control and transmission cabling for future tech. It is common for millennials to choose renewable and alternate energy sources that can power their homes. Smart grids to place excess energy back into power grids and energy saving gadgets and devices to reduce dependence on fossil energy is another sought after feature.

For their ideal home the type they would definitely like to possess, millennials are willing to wait and bide their time until they find it.

Asian Millennials

Elsewhere across the world, especially in Asian countries like India, China and Indonesia, millennials are the most prominent section of the population. Unlike their western counterparts, they have the desire, willingness and ability to purchase in greater measure due to rising economic growth.

As per the last Census in India (2011), millennials formed close to 700 million out of a total population of 1.3 billion. Indian millennials comprise around 46% of the total workforce and have an estimated spending capacity of around $3.6 billion (Business Insider, Aug,2021).

A distinguishing feature of Indian millennial home buyers is their inclination for an outstanding experience during any of the stages in the buying cycle. The home must perform very well when it comes to being hi-tech, providing a seamlessly connected lifestyle. The 4 characteristics that set them apart are

-

- Higher purchasing power

- Smart living

- Ready adoption of tech

- A high sustainability orientation

So, who are these millennials seeking luxury options? Obviously the ones who’ve been least affected by the pandemic. They are the ones who are the typical double -income- no-kids (DINKS) or with one kid or pet (DEWKs), who globe trotted, acquired expensive brands and generally lived a good life, and who now find themselves grounded due to travel restrictions. These millennials are on the lookout to invest in safe housing, with amenities that enable them to have a safe lifestyle for all members in the family, while supporting a work- from- home work ethic. The Financial Express (FE, April 2021) cites them as ones seeking large open spaces, clubhouses, shopping facilities, a gym, tennis courts, walk-parks, even car-charging spots for their additional electric vehicles. They want peaceful spaces with property management companies maintaining the premises, FE calls this the ‘tech -rich congregation’ found densely in cities like Bangalore, Hyderabad and the Delhi-NCR region.

Those who are not the tech -rich congregate, have made a beeline for affordable homes. Less than 5% of the millennials prefer to buy a home priced over Rs 1 crore. 39% of the respondents, who wished to buy homes, prefer to buy a budget property within Rs 40 lakh; 44% prefer to buy homes ranged between Rs 40 lakh and Rs 80 lakh; and 13% of the respondents indicated buying homes ranged between Rs 80 lakh and Rs 1 crore (FE, 2021). Work from home concept is evolving, so is investing in homes in the peripheral locations of the city where the twin parameters of affordability and lifestyle converge.

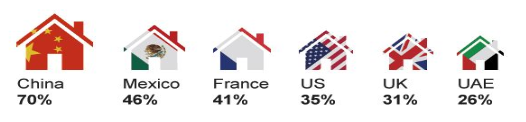

China has approximately 410 million millennials. Millennials here have a healthy capacity to consume housing. China has the highest percentage of millennials buying property, a whopping 70 percent, as per an HSBC study publicised by BBC in 2017. The millennials fly towards the cities as their chances of lifestyle and livelihoods are both met in the cities. China is building whole new cities to accommodate the influx of the young population arriving in cities in search of jobs. In the same report 9 out of 10 millennials wanted to own a home and had even set conditions for marriage for the spouse to be a homeowner (Insider, 2021). However, few factors since the HSBC 2017 study have changed. The Chinese economy has slowed down and the real estate market has become sluggish. Refer Fig. 3

Fig 3 Chinese Millennials have the highest home ownership in 2017 Study

(https://www.bbc.com/news/world-39512599)

In Indonesia a study on millennial home buyers’ preferences, inferred that pricing and quality of investment were the most important factors in purchasing affordable housing. And as is typical of affordable home buyers’ the pride of ownership was in case too, not as important as the core utility and services of the house.

In Thailand millennials desire lifestyle homes where there are less traffic jams, a good location, good layout and design and a reputed builder as the topmost priorities in home selection.

Generation Z or the Space Dreamers

If by now you have concluded that the millennials are a fussy bunch, you’ll be guessing how the generation close on the heels of the millennials, the Gen Z, views home ownership. These are the ‘youngistan’ who’ve begun to sniff around for suitable accommodation as they move into cities, launch their start-ups and begin their professional life as internet gurus, social media influencers and other interesting profiles one had never thought of, a few years ago. They are therefore the first generation born into smart tech, internet, and social media, earning the sobriquet “digital- natives”. Like the millennials they are well educated too and highly global in their outlook. This generation is open and ready for change in their careers, like one would change bikes! These are an integral part of a growing segment of India’s gig sector which is expected to grow to $455 billion by 2024, at a compounded annual growth rate of 17 per cent. As per some estimates, the US gig workforce already contributes over $1.5 trillion as 80% of large companies plan to actively adopt a flexible workforce (Sridharan S, Mishra B., BW 2021). The gig workers are not great fans of property ownership. They’d rather rent, live in communities or move to different places they fancy, not putting down their roots.

They are characterised by their extreme use of and preference for all things tech. Unlike the millennial cohort, the Gen Zs are sticklers for space. They love space, but are astute buyers and cost conscious too (David Lord, 2018). The primary reason to own is because they want their own space, they like investing in a home and also want to ensure their pet has adequate space. This generation does not look at social security as a source of income in their old age. They think their personal savings and ability to work till the end, will carry them through. Perhaps that’s why they appear to be more financially astute?

Generally Gen Zs are dreamers and hardly envisage a life which is rooted in one place. They are the first generation where they’ve been raised in the most diverse cultures. Their ability to accept persons of different origins, points of view, orientations and so on, is phenomenal.

Take the case of Ufuoma Ovienmhada, a 22 -year- old, second year Master’s student in the Space Enabled Research Group at the MIT Media Lab, here is where his sights lie “Space exploration and interplanetary habitation presents a unique opportunity for humanity to unlearn and learn again. I hope that the people leading the space-based societies seize the opportunity when the time comes.” Ufuoma’s work and research is not so utopian after all. The company, Axiom, in a deal with NASA has booked three paying passengers with an objective to make space more accessible to people. It is planning two flights and developing a space station to replace the

International Space Station. Like Ufuoma, there are scores of Gen Z who find space colonisation to become a reality in their time and are ready for it.

The older Gen Zs may be around 24 or 25 at present but they already show signs of being serious property acquirers by the end of this decade. Given their overall entrepreneurial nature and openness to experiment, they are a cohort worth watching closely.

The Sharing Economy, the Millennial and Gen Z Home Buyer

Both generations want what their parents want— seamless delivery of essentials of value, choice, quality, and convenience. However, as digital natives, they have their own expectations for how they want those essentials delivered. More and more housing providers will need to move from mere information power to negotiation, persuasion and relationships within networks and better marketing processes.

Are we seeing the writing on the wall? Look around and you will see billboards and advertisements for co-living spaces. Lifespace, Draper Startup House, The Hub, Space Butler, Six Peak, OpenDoor, Co-Living, The Collective, or GetSetHome, are a few names that are active in the co-living space in India. Co-living enables the young and restless coming into the city to find a community space with a private bedroom as it offers a means of affordable living for students, workers, digital nomads, or individuals relocating.

As economic activities get further reorganised thanks to the internet and smart technologies that will supplant the corporate-centric model of the 20th century. It will lead to shifting of work and wages out of centralized companies into crowd-based platforms that connect millions of independent providers with consumers (Sundararajan, 2018). While in the present, homeownership interest appears high among the Gen Z, followed by millennials coming in second, it remains to be seen which of the forces is stronger, leading to a change in use

and ownership of living spaces. One cannot therefore forget the increasing role of the likes of Air BnBs will play.

Homes have always been personal possessions and used exclusively by the owners and their families. However, being able to rent out space makes their use commercial too. Home buyers who think this way start to factor commercial revenue projections into their mortgage decisions, potentially making them willing to spend more. A comprehensive study by Calder, Wang and Sophie on the New York rental housing market showed a distinct advantage for host renters of the Airbnb types and a disadvantage to long term renters. The implications of this are humungous. Not only will the home ownership and the owner-renting market see major disruption, governments and property taxation policies will need also major overhauls.

Concluding Remarks

As mentioned above the gig economy has led to job volatility, leading to unpredictable income streams, full time jobs will no longer be able to sustain the housing mortgage market. increasing digitalisation and its associated consequences portend huge social changes e.g greater need for mobility and flexibility, growing social acceptance of shared consumption, and more individual resilience to change. Each of these parameters alters the importance of the investment value of a house, as well as the consumer calculus when committing to a monthly mortgage payment, foretelling a future in which innovation will be central to success in the industries associated with residential real estate and mortgage financing.

The shape of things to come lies somewhere between individual ownership and collective living options. I would predict a greater move towards asset light, shared spaces model gaining acceptance as a perfect outcome of the generations’ preference for collaborative consumption.

Dr. Mona N. Shah

Mona N. Shah, is an expert and thought leader in the field of education and research. Her work in the built environment has been considered noteworthy in providing thought leadership to the sector. The built environment is a vast sector that covers practically the whole gamut of human activities. As founder and director of Vayati Systems and Research she leads initiatives in leadership, education, skills training and research in projects, infrastructure, real estate sector and related industries.

Bibliography and References

Walia, A. and Chetty, P. (2020). Family life cycle stages in the marketing. [online] Project Guru. Available at: https://www.projectguru.in/family-life-cycle-stages-in-the-marketing/ [Accessed 19 Jul. 2021].

Evans, M., Jamal, A. and Foxall, G. (2006) Consumer behaviour. New Delhi: John Wiley &Sons.

http://www.naredco.in/news-updates-details.asp?id=27402&prYear=2020&xmon=Feb&st=1&links=

Meg Gorman, How Millennials Are Revolutionizing The Home Buying Process

https://www.forbes.com/sites/megangorman/2019/08/31/how-millennials-are-revolutionizing-the-home-buying-process/?sh=1a482d332a02

Hakim Lakdawalla, (2019). Millennials Buying Behaviour in the Current Housing Sector https://www.outlookindia.com/outlookmoney/real-estate/millennials-buying-behaviour-in-the-current-housing-sector-4105

Amit Goyal (2021). Millennials are upping luxury home demand now

https://www.financialexpress.com/money/millennials-are-upping-luxury-home-demand-now/2241026/

T.J. Mathews, M.S.; and Brady E. Hamilton, (2016). Mean Age of Mothers is on the Rise: United States, 2000–2014 NCHS Data Brief, Number 232, January 2016 (cdc.gov)

75% millennials want to buy a home in another 3 years: Study FE Online 2020

https://www.financialexpress.com/money/75-millennials-want-to-buy-a-home-in-another-3-years study/1869094/

Rebecca Seales (2017). The country where 70% of millennials are homeowners

https://www.bbc.com/news/world-39512599

Anil Urs (2021). Millennial prefer home ownership over renting: Survey

https://www.thehindubusinessline.com/news/real-estate/millennial-prefer-home-ownership-over-renting-

survey/article33861200.ece

Hankin A., and Mansa J. (2021) The Real Reasons Millennials Aren’t Buying Homes

https://www.investopedia.com/news/real-reasons-millennials-arent-buying-homes/

Rebecca Lake, 2021, How Millennials Are Changing the Housing Market,

https://www.investopedia.com/personal-finance/how-millennials-are-changing-housing-market/patterns-of-

home-buyers

Jun 18, 2020 Deepak GoradiaVice-Chairman and Managing DirectorDosti Realty

https://www.99acres.com/articles/changing-behavioural-patterns-of-home-buyers.html

Report (2020) WELCOME TO GENERATION Z.

https://www2.deloitte.com/content/dam/Deloitte/us/Documents/consumer-business/welcome-to-gen-z.pdf

Deloitte Millennial Survey https://www2.deloitte.com/content/dam/Deloitte/global/Documents/About-

Deloitte/gx-dttl-2014-millennial-survey-report.pdf

Ashni Walia and Priya Chetty (2020). Family life cycle stages in the marketing

https://www.projectguru.in/family-life-cycle-stages-in-the-marketing/

David Lord (2020). Why the younger Gen Z has an edge over millennials in the housing market

https://www.marketwatch.com/story/why-the-younger-gen-z-has-an-edge-over-millennials-in-the-housing-

market-2018-11-27

https://www.insider.com/meet-the-typical-chinese-millennial-income-housing-ambitions-2021-7#chinas-

millennials-are-the-countrys-first-privileged-generation-2

Srinath Sridharan, Bhawana Mishra (2021). Virus’ Vitality as A Lesson For GEMZ (Gig Economy, Millennials &Gen-Z ) 2021. http://www.businessworld.in/article/Virus-Vitality-as-a-Lesson-for-GEMZ-Gig-Economy-

Millennials-Gen-Z-/04-02-2021-373622/

Professor Andrew Baum, Andrew Saull and Fabian Braesemann (2020). The future of real estate in the shared economy – Part 2. Saïd Business School – University of Oxford

https://www.rics.org/en-in/wbef/megatrends/digital-transformation/real-estate-shared-economy-part-two/

Christian Davenport (2018). Meet the people paying $55 million each to fly to the space station.

https://www.washingtonpost.com/technology/2021/01/26/private-space-flight-axiom/

Mark Holmes Gen Z and Millennials Take Space Industry to Task

http://interactive.satellitetoday.com/via/december-2019/gen-z-and-millennials-take-space-industry-to-task/

Matt Weinzierl, Mehak Sarang (2021). The Commercial Space Age Is Here. Private space travel is just the

beginning.

https://hbr.org/2021/02/the-commercial-space-age-is-here

Image Courtesy: https://s28126.pcdn.co/blogs/ask-experian/wp-content/uploads/The-Millennials-Guide-to-Getting-Mortgage-Ready.jpg